Free Cap Table Template

Pulley helps companies navigate early equity decisions and grows with you as you scale.

Build your first capitalization table by downloading our free Cap Table Template in Google Sheets.

How to use the template:

1. Add your authorized shares

2. Input your securities into the appropriate ledger tab, where appropriate

3. View your Summary Cap Table tab

Free Cap Table Spreadsheet for Growing Startups

Equity management starts out simple, but even the most basic cap table needs structure. That’s why we put together a free, easy-to-use Google Sheets template for early-stage founders.

Spreadsheets are a common and valid way to track ownership in the beginning. They’re free, flexible, and easy to share. But as your company grows, spreadsheets can become messy. Small mistakes turn into bigger errors, and fundraising becomes harder than it should be.

This template helps you start on the right foot. Use it to manage your first equity records with clarity, and when complexity arrives, you’ll have a smarter path forward.

Download our free cap table template

Our Google Sheets cap table template makes it easy to organize ownership from day one. It includes pre-built formulas and a summary view that shows who owns what at a glance. If you want a deeper dive into how capitalization tables work, check out our cap table guide.

The template includes:

A structured format for tracking shares and stakeholders

Ledger tabs for founders, employees, and investors

Automatic summary tab for quick insights

Simple setup with built-in formulas

Need a simple, editable cap table to get started? Download our free Google Sheets template built by startup equity experts.

Who this template is best for

Early-stage founders can use this template to track ownership with clarity. If your company is small, has only a few stakeholders, or is raising its first round <, this spreadsheet helps you manage equity with confidence.

Early-stage founders can use this template to track ownership with clarity. It’s ideal for small teams with just a few stakeholders or those who have raised a friends-and-family or pre-seed round. The spreadsheet helps you manage equity confidently and stay organized from day one.

However, once you’ve incorporated, consider using an affordable cap table management tool like Pulley to save time and reduce errors as your company grows.

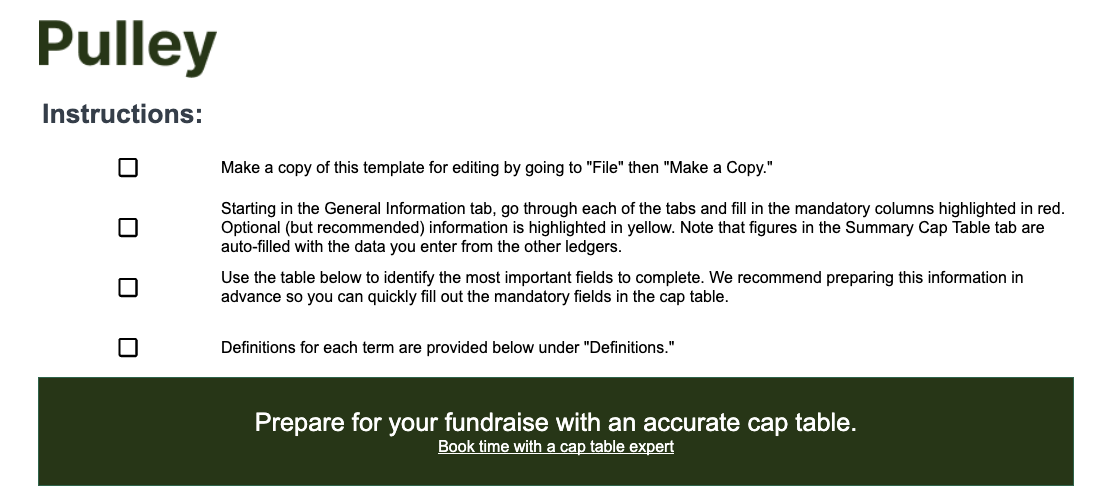

How to use this cap table template

Step 1: Add your authorized shares

Start in the General Information tab. Fill every mandatory field highlighted in red. Optional fields are highlighted in yellow. The authorized shares value in the Summary Cap Table tab is auto-filled from the General Information data, so confirm it’s populated correctly before you move on.

Authorized shares are the maximum number of shares your company can issue, as stated in your certificate of incorporation. This number is usually larger than the shares you’ve already issued.

Why it matters:

Sets the ceiling for how much equity you can grant

Helps track dilution as you add new stakeholders

Keeps your records consistent with your legal documents

If you’re unsure where to find this number, check your incorporation paperwork or ask your lawyer.

Pro tip: Pulley automatically tracks authorized shares and updates your summary view in real time, reducing manual errors.

Step 2: Input your securities

Next, record the equity you have actually issued. Each type of security has its own tab in the template:

Common stock: Usually held by founders and early employees

Preferred stock: Typically issued to investors during funding rounds

SAFEs and convertible notes: Early-stage financing instruments that convert into equity later

Incentive plans (options): Grants for employees or advisors that give them the right to buy shares in the future

Be sure you enter each stakeholder in the correct tab to keep the spreadsheet organized and ensure the summary view calculates correctly.

Pro tip: Pulley organizes each security type automatically and calculates dilution for you, so there’s no broken formulas or misaligned tabs.

Step 3: View your cap table summary

Once you enter your data, head to the Cap Table Summary tab. This view automatically pulls together the details from each ledger to show a snapshot of your company’s equity.

You can expect to see:

Ownership by stakeholder

Percentage ownership by group (founders, employees, investors)

Total number of shares issued versus authorized

Dilution over time as new securities are added

This summary gives you and your investors a clear picture of who owns what, so you can make decisions with confidence.

When a spreadsheet cap table works—and when it doesn't

Excel spreadsheets are a great way to start tracking ownership, but they can also create headaches as your company grows. Knowing when to stick with a spreadsheet and when to switch to software saves you time, stress, and potential mistakes. Some investors may require the use of a cap table platform as part of their due diligence before investing.

Pro tip: Pulley organizes each security type automatically and calculates dilution for you, so there’s no broken formulas or misaligned tabs.

It’s okay to use a spreadsheet if you're just getting started

A spreadsheet is suitable for small companies with simple equity. For example:

You are pre-seed or just incorporated.

You have fewer than 10 stakeholders.

You are using SAFEs only.

You have not granted equity to employees yet.

At this stage, a spreadsheet works well since it’s free to use, fast to set up and edit, and a familiar format your lawyer may have already shared. Consider a tool like Pulley to make future growth easier.

Upgrade when things get more complex

At a certain point, spreadsheets stop being enough. It may be time to move to dedicated cap table software if you:

Grant employee stock options

Have raised or are planning to raise a priced round soon

Need a 409A valuation for option grants

Have board-level or institutional investors who expect accurate reporting or require the use of a cap table provider.

Sticking with spreadsheets too long creates real risks, including these:

Manual tracking gets messy: Management of different securities can cause miscalculations and inconsistencies.

Formulas break: One incorrect cell can distort ownership percentages and create reporting errors.

Spreadsheets cannot manage equity: They can track ownership, but they don’t issue shares, process grants, or update holdings automatically.

Compliance concerns: Mistakes during audits or fundraising events can cost money and damage investor trust.

Example: A founder raising their Series A discovers an error in their option pool calculations. Fixing it delays the round, requires new legal paperwork, and raises investor compliance concerns. In the worst case, an investor could withdraw, and the relationship may be damaged.

Pro-tip: Cap table software helps you avoid these problems by keeping ownership data accurate, auditable, and ready for the next stage of growth.

Cap table spreadsheets vs. equity software

Spreadsheets can become messy as your startup grows. Pulley’s equity software organizes shares and grants, scaling with your company. Founders can handle more tasks themselves, reducing legal fees and staying in control rather than relying entirely on legal teams. This makes it a better solution for both small teams and growing startups. Here’s how Pulley compares to spreadsheets and other cap table tools:

Ready to save time, reduce errors, and impress investors? Explore how Pulley can grow with your cap table.

Pro tip: Pulley’s scenario modeling helps you stack SAFEs, plan pro-rata, and visualize dilution instantly in one platform.

Early upgrades save time and legal fees

DataOceans’ transition from spreadsheets to Pulley demonstrates the clear advantages modern equity management offers. CEO Larry Buckley explains the efficiency gains:

"The Pulley team set up in a fraction of the time compared to our previous provider. We were able to get started with minimal effort on our side, product, and the service we have received."

Previously, DataOceans faced inefficient manual 409A processes. Pulley’s streamlined approach improves confidence in valuations:

"For DataOcean’s 409As with Pulley, the process was streamlined and simple. They used underlying cap table data and communicated the process and methodology. Buckley was much happier with the result and trusted the valuation."

Additionally, Pulley keeps stakeholders in the loop with real-time access to equity holdings and vesting schedules. With up-to-date data, stakeholders gain greater confidence in the company’s equity management.

This case study demonstrates that adopting a comprehensive equity management platform like Pulley early can deliver significant time and cost savings. It also reduces reliance on spreadsheets and helps simplify legal processes.

Stay in control of your cap table with Pulley

Many founders start with spreadsheets, but as your startup grows, spreadsheets quickly fall short. Pulley handles what they can’t—real-time updates, scenario modeling, compliance, equity issuance, and investor-ready reporting.

Stay organized, scale confidently, and keep control of your cap table. Book a demo today.